🍀 Regarding @SoSoValueCrypto, one thing that often discourages us is interacting and writing posts at the same time, and XP doesn't increase. But don't be discouraged, I've seen many people just starting out, but their affiliate points are boosted a lot; if you don't do it, how can you increase your XP?

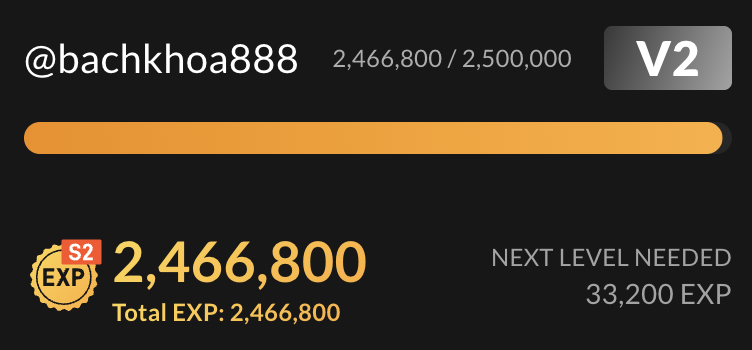

I'm also just about to move from V2 to V3, my goal is V3 only, as I can't gain more, it's very difficult but don't be discouraged. This post is for everyone to interact and drop affiliate links so that those who haven't joined #SoSoValue can support.

Here's my interaction link:

Feel free to leave your interaction links below; if you don't support me, support others. Yolo, for a smooth start to 2026. Hope to finish before the Lunar New Year so everyone can be happy.

🍀 Crypto Space over the last 5 years – How can we survive and seek for opportunities ?

Back in early 2020, the entire market had just under 10,000 crypto projects. It can be said that the period of 2020-2021 was the best time for Crypto investors. The market was healthy, the number of listed projects was very small, Backers were active and serious in finding quality projects to join. As a market researcher and writer, at that time I could cover all the projects that had launched, were about to launch or had just raised capital, from Docs to their activities with the community and development roadmaps associated with many great missions.

And up to now, the entire market has had more than 30 million Crypto projects. A very massive number in the past 5 years. I don't think I can learn about all the projects, absolutely impossible. There was a time when I was caught up in the whirlwind of new projects, as well as projects on Decentralized Exchanges. Until now, after experiencing and witnessing many opportunities and mistakes of those participating in Crypto, this article will provide the most general view so that everyone can find your own Investment Thesis.

1. Why do we see such a huge number of projects launched?

I can answer this question, based on 2 main factors, 2 reasons that have made the crypto market very fragmented.

• Launching tokens is not regulated by any authority

The issuance of tokens too easily has caused chaos in the market, led by platforms like Pumpfun. I myself am also an investor who has bought meme tokens, but I will argue if you think that meme is a part of Crypto and Blockchain. Meme is only similar in form to Crypto and Blockchain, but the purpose has been completely deviated. I am not talking about iconic memes with established communities like $DOGE or $SHIB.

• Social media and tweets from KOLs make the community FOMO

We cannot stop the community's FOMO in front of multiple gain opportunities. However, Researchers and KOLs have taken things too far. Advertising projects with extremely low liquidity and market cap with "promising theses" has exhausted and fragmented the market's cash flow.

2. Current Crypto narratives only last a few weeks, even a few days. Why?

Back in 2020-2021, investors often followed and held a very long narrative, up to several months. Newcomers to the market may not know “Play-to-earn”, but it was a huge narrative in the summer of 2021. We had a few brilliant months, led by $AXS, along with many other quality projects, with a huge price increase. So why is the trend shorter now than before?

Except for #AI and #RWA which are fueled by traditional finance from #NVIDIA and #Blackrock, the remaining trends are very short. There are 2 reasons for this problem:

• A large number of projects: as mentioned in point 1, if there is a project in the trend 2x in 1 day. But, which project will you choose to buy, among thousands of projects?

• The role of Market Maker (MM) is larger than the old cycle: admit that, a project in a 2x trend in 1 day, mostly comes from the MM of that project, not from the objective motivation of that narrative to pull the entire ecosystem up. It is simply the game of a top gain project, not the real strong growth of a narrative.

3. How can we survive and seek for opportunities?

• We need to redefine our investment mindset to have a reasonable plan

- The Crypto market is cyclical, although the current cyclical nature is no longer effective to base on, but it is still true, at least with $BTC. If you are not a good trader or a technical analyst, you should choose the right time to invest and only focus on $BTC and a few projects in the top market cap. Now it's 2025, similar to 2021, whether or not there is another growth pulse of the market, the market will enter a downtrend cycle. This is not the time to invest large capital in the market anymore.

- When the whole market goes into a downtrend, when everything is no longer too hype, that's when we need to act. $BTC $ETH and $LINK will be 3 safe and profitable choices for you in the next cycle. I recommend you pay attention to projects that have launched #ETF if you have to choose, because in fact, the cash flow running in #ETF fund and running in the Crypto market are different, and only #ETF can attract real cash flow from fertile markets like the United States. Even if the market launches many more projects, we will still have to talk about Top market projects, because that is the core, what has shaped the market, what Blockchain needs, and will increase in price.

• Reasonable capital allocation along with DCA plan for each project in the Portfolio

- Reasonable capital allocation is always correct, applicable to all markets and types of financial investment. We cannot know in advance which project will gain or lose, or even be delisted, so we have to allocate investment capital. My familiar investment allocation method is always 80-20. 80% using for tokens, 20% remaining for stablecoins. If you do not have a certain amount of stablecoins in your wallet, you will always be in a state of anxiety when the market drops, leading to panic, and the cycle of panic sell panic buy keeps repeating.

- DCA is a classic method, and I recommend everyone to seriously apply it. You cannot all-in at a specific price and think that is the bottom of the market. That is what you think, but the market has never gone in the direction you want, that is why we have to DCA to avoid pressure when holding assets. Many people underestimate and ignore DCA, but believe me, the more profitable your investment is, the more you must have a reasonable DCA plan.

• What should we do when holding tokens?

- There is a way to reduce your distraction, avoid selling this project and buying another project arbitrarily, that is, focus on other money-making niches in the Crypto market. I find that SocialFi with Kaito is currently an effective solution, both financially and helping you discover more quality projects. In addition, #SoSoValue and some other projects also have very good programs for articles. Do serious researches and share your thoughts, you will be welcomed, along with a stable economy to overcome the harsh days of holding Tokens

- If you want to FOMO a certain narrative that is hyping, note that you should only spend a maximum of 5% of your total assets. Not controlling your emotions and not having discipline is what will get you off the track the fastest.

• Don't be pressured by top market and large capitalization projects

- There is a truth about investor psychology, based on greed and lack of understanding of the market. Everyone thinks that top market projects is not attractive to increase as low cap projects. But everyone’s wrong. Let’s see projects in top 10 Coinmarketcap, except USDT and USDC, they’re all have the average of 5x on return when you bought in 2023. Isn't this price increase, isn't this profit?

- Back to Point 3, the first thesis. The most important thing to consider about is buying timing. Buy when no one is talking about market, when no one is excited about it, and based on 4-year cycle with detailed plan for DCA and allocation, you will be relax on investment journey.

This is all I have learned after many years of investing, researching, collaborating with many projects as well as running a small crypto organization. Simple but not everyone can understand and execute it. I hope everyone can find my article helpful.

#Tokenbar #SoSoScholar

More in

@SoSoValueCrypto Don't be discouraged. Also, don't look at others with high EXP; they started early and interacted a lot, so they have good results. If you're coming in later, just try harder.

11.34K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.