Great summary - wake up its nearly 2026 not 2021

Additional thoughts/comment

1. Seen a lot of similar takes from DevConnect - having an institutional strategy is the new must have for your product.

2. "old playbook isnt working" - If you are still sitting and waiting for retail you are f*cked. Step out of 2021 into 2025 soon '26

3. Revenue buybacks are a sales pitch unless there is actual revenue + the company uses it to buy their token back - eg Hyperliquid one one end of the scale, Rhea on the other

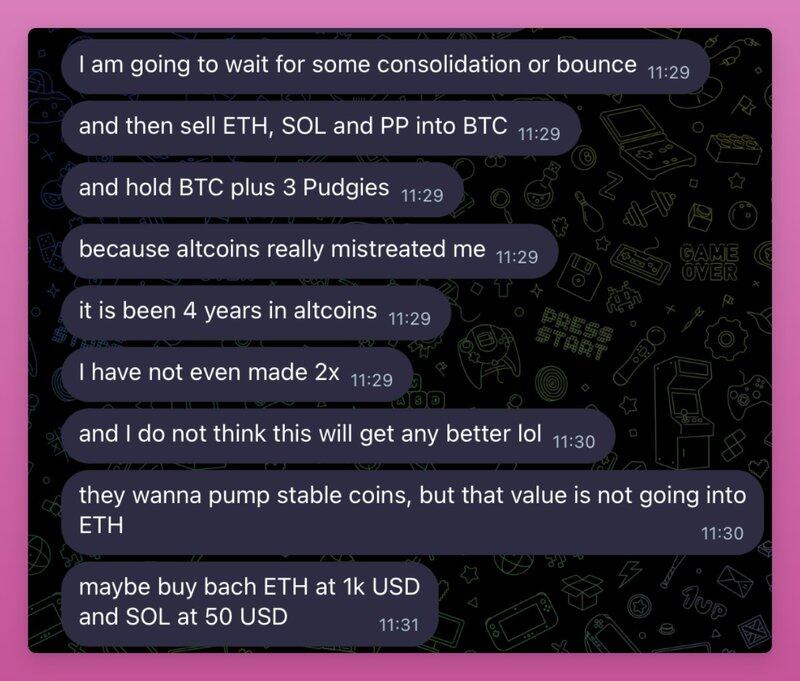

4. "alts mistreaded me" - Crypto is a high risk asset, you are trading - tokens dont mistreat you. You mistreat yourself but not accepting the risk you are undertaking.

DYOR - research. Not DYOG - gambling

5. As traders say, trade the chart in front of you not the chart you wish for. Applies to everyone builders, traders.

Appreciate the post, enjoying these common sense/reality check posts of late.

Seeing full capitulation on alts across CT and in my DMs.

People skipped BTC early in the cycle expecting the old playbook to repeat.

But new money didn’t touch the old, boring tokens. First, we got rekt on low-float, high-FDV tokens.

Then on memecoins.

DAT trades weren’t any better.

Retail expected Saylor 2.0 companies, but instead we became exit liquidity for insiders.

But as all looks lost, the altcoin playbook is changing:

5 of the top 10 lending apps are buying back their tokens.

Uniswap and Lido also turning the fee switch on.

Top protocols finally rewarding holders sends a clear signal to other teams to follow. But...

...it doesn't necessarily save alts for the time being:

Most have no revenue to share and those that do, are still way overvalued relative to FDV.

Thus alts continue repricing their speculative, "new thing" premium towards P/E or whatever ratios that make sense.

Key catalyst to follow is the CLARITY act that will, well, give clarity on alts:

Regulation won't mean green light to pump all alts. But like during all regime changes, there will be new winners and losers.

5,96 mil

6

O conteúdo desta página é fornecido por terceiros. A menos que especificado de outra forma, a OKX não é a autora dos artigos mencionados e não reivindica direitos autorais sobre os materiais apresentados. O conteúdo tem um propósito meramente informativo e não representa as opiniões da OKX. Ele não deve ser interpretado como um endosso ou aconselhamento de investimento de qualquer tipo, nem como uma recomendação para compra ou venda de ativos digitais. Quando a IA generativa é utilizada para criar resumos ou outras informações, o conteúdo gerado pode apresentar imprecisões ou incoerências. Leia o artigo vinculado para mais detalhes e informações. A OKX não se responsabiliza pelo conteúdo hospedado em sites de terceiros. Possuir ativos digitais, como stablecoins e NFTs, envolve um risco elevado e pode apresentar flutuações significativas. Você deve ponderar com cuidado se negociar ou manter ativos digitais é adequado para sua condição financeira.