With $UNI Back BELOW its pre–proposal announcement levels, we think it is the perfect time to explain why we believe UNI will in fact become deflationary.

Let’s dive into our research 👇

Uniswap’s historical protocol volume and revenue growth rate (%):

Due to significant outliers from the October 10th market crash, we used a 3-month average. Protocol revenue refers to the final calculated token burn amount.

Calculation methodology:

For V2 & V3, we followed the exact specifications from Uniswap's Unification Proposal. For V4, we estimated approximately 15% value extraction to UNI holders.

For Unichain, we project 85% to UNI holders

MEV internalization and redistribution to UNI burn, based on the MEV Internalization mechanism outlined in the PFDA:

The $Uni token burn analysis illustrates how much in protocol fees from MEV capture would have been used to burn UNI tokens based on historical volume data, had MEV capturing been implemented from the start.

A 16.7% allocation was assumed for burning $UNI tokens through captured MEV fees, matching the exact allocation of LP fees in Uniswap V2 designated for $UNI token burns. For estimating captured MEV fees, we used the upper and lower bounds of the Uni team's own estimates, along with the median value of the Uniswap team's projections.

We concluded that MEV internalization from Uniswap is expected to result in approximately $750,000 to $3,200,000 in additional UNI token burn based on historical projections (annually).

Overall, this benefits LPs by providing an additional yield source that offsets the reduction in fees

The key takeaway is that MEV internalization will not have a significant impact on UNI token holders, but it is overall beneficial for LPs as it represents an additional way to improve LP efficiency

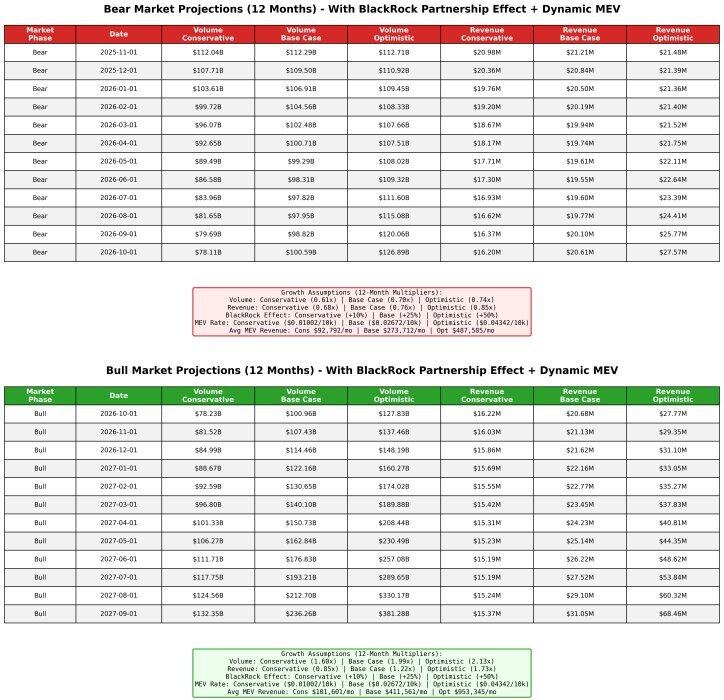

Future Volume & Protocol Revenue projection

(bear and bullmarket) (MEV internalization included)

Methodology:

Future bear and bull market projection methodology: The code determines the 12-month multiplier data for the bear market and bull market 2 (2023-2025) respectively. 12-month multiplier data means it calculates all possible 12-month periods within each market phase by determining the growth 12 months later from every possible starting month (13 data points for bull market 2 and 8 for bear market).

From the 12-month multiplier data, the 25th percentile value is taken for the conservative scenario, the median value for the base case scenario, and the 75th percentile for the optimistic scenario.

Using the determined percentile values, the respective growth is then projected at the end of the historical data for 12 months of bear market and subsequently for 12 months of bull market.

MEV capturing revenue has been incorporated into the future protocol revenue projections. The calculation uses the Uniswap team's own estimates: the lower bound for the conservative scenario, the median for the base case scenario, and the upper bound for the optimistic scenario.

These MEV revenue estimates were then calculated based on the projected future trading volume.

One key takeaway from this data is that Uniswap’s revenue fluctuation:

Despite these sharp swings, the protocol demonstrates strong resilience. The difference in revenue between bear and bull markets is about 30-40%

relevant to concerns about a large percentage of LPs leaving the system:

Gauntlet research showed that with a 10-20% protocol fee switch, Uniswap would lose less than 4% of core trading volume.

Those citing the Perfect Elasticity theory often overlook that LPs tend to be sticky in practice, empirically, only 37% elasticity was observed, so the actual loss of liquidity is much smaller than theoretical models predict. It remains to be seen how this will play out in the market

Rumors of a potential partnership with BlackRock would represent one of the product line expansions Uniswap might pursue, which could drive both volume growth and revenue increases.

We expect (if true) annual volume growth of 10-50% throughout the year, which would translate to an average revenue increase of around 30%

Relative Valuation Compared to other buyback projects

By examining historical data, we can model how an earlier implementation of the fee switch would have performed:

When evaluating monthly buybacks, the key metric is sustainability and consistency rather than absolute volume.

While platforms like Pump exhibit volatile patterns,

Hyperliquid and Uniswap demonstrate more stable and predictable buyback quality.

Uniswap's Market Dominance:

Uniswap’s volume ranges around the factors of 15-30x.

Crucially, Uniswap has already achieved PMF, maintaining relatively consistent volume numbers through both bear and bull cycles, which provides a stable foundation for revenue generation.

Addressing Budget Concerns

- The proposal authorizes selling up to this amount, not mandating the full amount be sold

- The budget was calculated when UNI traded at $4, versus the current $7

Underestimated revenue potential:

Most analysts are significantly undervaluing Uniswap's

growth catalysts:

Two key factors:

1⃣ Product line expansion opportunities

2⃣Protocol efficiency improvements

These developments will contribute to making UNI deflationary.

We firmly believe the fee switch implementation will result in a deflationary token model

3,83 mil

41

O conteúdo apresentado nesta página é fornecido por terceiros. Salvo indicação em contrário, a OKX não é o autor dos artigos citados e não reivindica quaisquer direitos de autor nos materiais. O conteúdo é fornecido apenas para fins informativos e não representa a opinião da OKX. Não se destina a ser um endosso de qualquer tipo e não deve ser considerado conselho de investimento ou uma solicitação para comprar ou vender ativos digitais. Na medida em que a IA generativa é utilizada para fornecer resumos ou outras informações, esse mesmo conteúdo gerado por IA pode ser impreciso ou inconsistente. Leia o artigo associado para obter mais detalhes e informações. A OKX não é responsável pelo conteúdo apresentado nos sites de terceiros. As detenções de ativos digitais, incluindo criptomoedas estáveis e NFTs, envolvem um nível de risco elevado e podem sofrer grandes flutuações. Deve considerar cuidadosamente se o trading ou a detenção de ativos digitais é adequado para si à luz da sua condição financeira.