WLFI Token Surpasses $7.5 Billion Derivatives Volume in Secondary Market Debut

Key Insights:

- WLFI launched on decentralized exchanges at 8:00 AM ET with an opening price of $0.28.

- The derivatives volume reached $7.5 billion within one hour, ranking as the fifth-largest perpetual by volume.

- The token was not initially planned for secondary trading until the approval of a governance proposal was obtained.

World Liberty Financial’s WLFI token experienced significant trading activity across both decentralized and centralized platforms following its secondary market launch on Sept. 1.

The token surpassed $7.5 billion in derivatives volume and reached $933 million in open interest (OI) within an hour after going live.

Explosive Launch Metrics

WLFI launched at 8:00 AM ET on decentralized exchanges and 9:00 AM ET on most major centralized platforms with an opening price of $0.28.

The token briefly spiked to $0.33 before settling at $0.2735 by 10 AM ET, representing a 2% decline from the launch price.

Decentralized exchange volume reached significant levels across multiple blockchain networks.

Ethereum captured the largest share with $73.8 million in trading volume through Uniswap. Solana networks contributed significantly with $22.1 million through Meteora and $21.4 million through Raydium. BSC registered $100,000 in volume via PancakeSwap.

The derivatives market response proved even more explosive. According to Coinglass data, WLFI perpetual contracts generated over $7.5 billion in trading volume within the first hour across centralized exchanges.

The volume positioned WLFI as the fifth-largest perpetual contract by volume in the past 24 hours, falling less than $700 million short of XRP’s fourth-place position. The open interest reached $933 million.

Further, Hyperliquid emerged as a major venue for WLFI derivatives trading. The platform recorded $264.7 million in perpetual volume during the past 24 hours with open interest at $124 million.

Since pre-market trading became available on Aug. 23, WLFI perpetuals on Hyperliquid accumulated nearly $3 billion in total volume.

The strong pre-market interest indicated substantial pent-up demand for WLFI exposure before secondary trading became available. This demand translated into explosive volume once official trading commenced across major platforms.

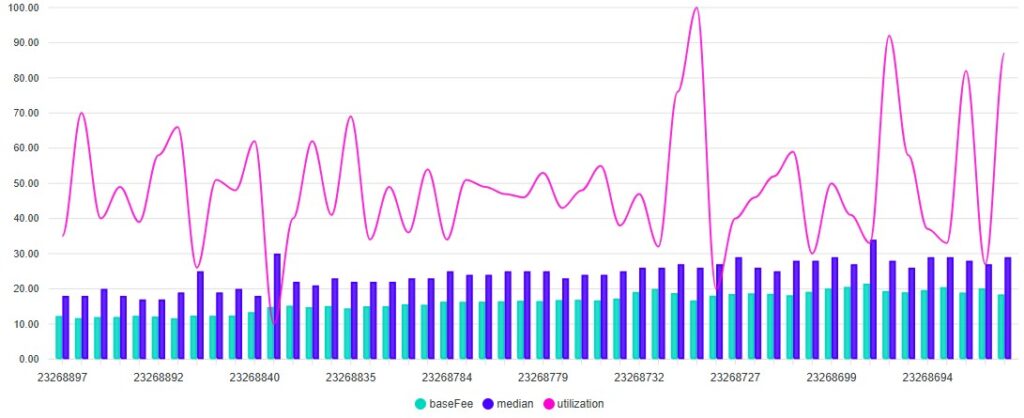

In addition to the volumes, the WLFI launch created significant congestion on the Ethereum network. Gas fees spiked from typical levels around 0.20 Gwei to 2.54 Gwei, representing a 1,170% increase.

Ties with the Trump Family

World Liberty Financial is the DeFi project backed by President Donald Trump and his family members, including Eric Trump, Donald Trump Jr, and Barron Trump.

The company was founded in 2024 and has been noted for its direct advertising of its connection with Donald Trump and his family.

The project’s goal is to ensure the dominance of U.S.-pegged stablecoins, positioning itself as a bridge between traditional finance and decentralized systems.

The Trump family maintained significant involvement in the project’s governance and economics. Donald Trump’s company title is “chief crypto advocate”, Barron Trump is listed as the project’s “DeFi visionary”, and Eric Trump and Donald Trump Jr. each have the title “Web3 ambassador”.

A Trump business entity owns 60% of World Liberty and is entitled to 75% of all revenue from coin sales.

Significant On-chain Moves

Early traders capitalized on the launch volatility with remarkable speed. According to blockchain analytics from Lookonchain, one smart trader generated approximately $264,000 in profits within less than 10 minutes of the decentralized exchange launch.

Large presale participants moved quickly to centralized exchanges following token claims. Notable transactions included one address claiming 60 million WLFI tokens worth $19.2 million and depositing them to Binance.

Similarly, a second early investor claimed 53.33 million WLFI, valued at $17.1 million, for Binance deposits, while a third wallet claimed 46.67 million WLFI, worth $14.9 million, for exchange deposits.

Interestingly, World Liberty Financial itself participated in the secondary market. Within one hour of the decentralized exchange launch, the protocol spent 2 million USDC to purchase 6.5 million WLFI tokens at $0.3078 per token.

Spillover Effects

The WLFI launch created unexpected spillover effects in related markets. The TRUMP memecoin experienced nearly $1.5 billion in daily trading volume, ranking as the 10th-largest volume for the period.

The memecoin perpetual contracts performed even stronger with almost $2.5 billion in daily volume, representing a 221.6% increase and securing the 9th-largest position. Open interest reached $491.7 million, reflecting sustained interest in Trump-related crypto assets.

WLFI’s secondary market debut represented a significant departure from original plans. World Liberty Financial initially designed the token without intentions for secondary trading, focusing instead on governance utility within the protocol ecosystem.

However, the approval of a governance proposal on July 16 enabled the secondary market launch.

The post WLFI Token Surpasses $7.5 Billion Derivatives Volume in Secondary Market Debut appeared first on The Coin Republic.